Home Loan Calculator UK

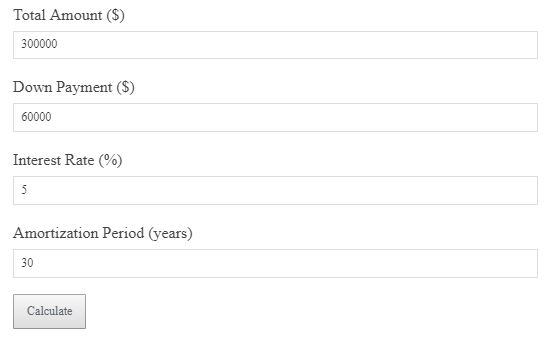

This home loan calculator helps you estimate your monthly payments, total repayment amount, and total interest for a home loan in the UK.

- UK home loan calculator

- Mortgage loan payment estimator

- Interest rate comparison tool

- Mortgage repayment planner

Loan Formula

Monthly Payment = Loan Amount × Monthly Interest / (1 – (1 + Monthly Interest) ^ -Number of Payments)

Total Repayment = Monthly Payment × Number of Payments

Total Interest = Total Repayment – Loan Amount

Example Calculation

£250,000 loan, 3.5% interest rate, 25 years → Monthly Payment: £1,245.53, Total Repayment: £373,658.54, Total Interest: £123,658.54

Why It Matters

Knowing your monthly payments and total interest can help you plan your finances effectively before taking out a home loan.

Smart Strategy

Consider paying a larger deposit or shortening the loan term to reduce the amount of interest you pay over time.

FAQs

What’s the ideal loan term? A shorter loan term reduces the total interest paid, but increases monthly payments. Consider your budget before deciding.

How does interest rate affect my loan? A higher interest rate increases both your monthly payments and total repayment.

Can I change my loan terms? Yes, many lenders allow you to adjust your loan term after the initial agreement, though fees may apply.