Biweekly Car Payment Calculator (Accelerated Payoff Estimator)

Biweekly car payments split your monthly amount in half and pay every two weeks. Because there are 26 biweekly periods in a year, you effectively make 13 “monthly” payments annually. That extra payment reduces principal faster and cuts total interest.

- Monthly vs. Biweekly: how many payments per year?

- Interest savings from one extra payment per year

- How to automate biweekly transfers

- Extra payment & early payoff strategies

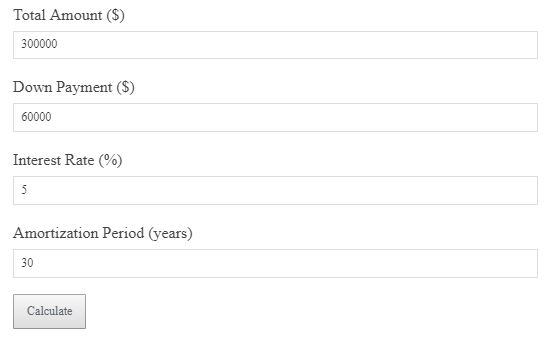

How to approximate biweekly with this calculator

1) Compute the monthly payment above.

2) Divide it by two — that’s your biweekly amount.

3) Because you make 26 biweekly payments, you’ll pay roughly one extra monthly payment per year. Use an amortization table or lender-provided biweekly schedule to see exact savings.

Standard Amortization Formula (Monthly)

M = P × r × (1 + r)n / [(1 + r)n − 1]

Note: The formula above computes the regular monthly payment (not biweekly). The biweekly effect comes from paying half the monthly amount every two weeks, producing ~13 monthly equivalents per year.

FAQs

Does biweekly always save money? Yes, if your lender applies payments when received. The earlier principal reduction lowers interest accrual.

Any caveats? Some lenders hold partial payments until month-end or charge fees. Confirm how your servicer posts biweekly payments.

What if cash flow is tight? Consider voluntary extra payments quarterly instead. Even small principal prepayments reduce interest.